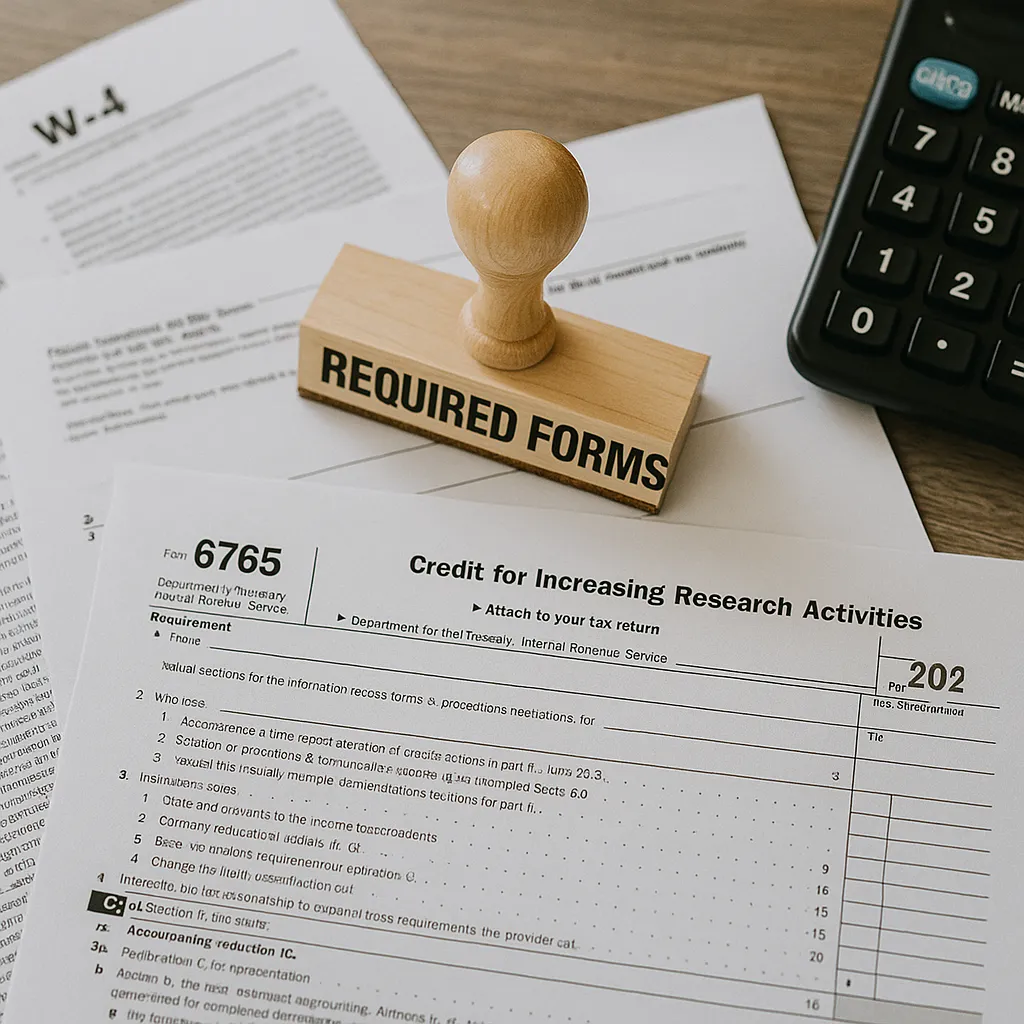

📄 Required Forms for Filing the R&D Tax Credit: What You Need to Know

If you're a startup or small business investing in innovation, the Research & Development (R&D) Tax Credit can be a powerful tool to reduce your tax burden or offset payroll taxes. However, to take advantage of this incentive, it's crucial to file the correct forms and supporting documentation with the IRS.

Here’s a breakdown of the essential forms involved in claiming the R&D Tax Credit and what each one means for your business 📚

🧾 Form 6765: Credit for Increasing Research Activities

Form 6765 is the primary form used to calculate and claim the R&D Tax Credit. This is where you report qualified research expenses (QREs), choose your calculation method, and elect to apply the credit toward payroll taxes if eligible.

It contains four parts:

Section A – Regular Credit

Section B – Alternative Simplified Credit (ASC)

Section C – Payroll Tax Election for Qualified Small Businesses

Section D – Recapture and Other Adjustments

✅ Tip: If your business has less than $5 million in gross receipts and no gross receipts before the five-year lookback period, Section C allows you to offset up to $500,000 in payroll taxes annually.

🧮 Form 3800: General Business Credit

Form 3800 is used to claim the R&D credit — along with any other business credits — on your business tax return. This form aggregates all eligible credits and applies them against your income tax liability. It’s required if you're using the R&D credit to reduce your income taxes instead of payroll taxes.

The credit calculated on Form 6765 is carried over to Form 3800 before it is applied to your return (typically Forms 1120, 1120S, or 1065).

💼 Form 8974: Qualified Small Business Payroll Tax Credit (If Applicable)

If you’re a Qualified Small Business using the R&D tax credit to offset payroll taxes, you’ll also need to file Form 8974.

Form 8974 is submitted alongside Form 941, your quarterly payroll tax return. It determines how much of your R&D credit can be applied each quarter.

To qualify, your business must:

Have gross receipts of less than $5 million in the current year

Have no gross receipts before the five-year period ending with the current year

This form ensures the IRS applies your credit correctly against your payroll tax obligations.

📂 Supporting Schedules and Documentation

In addition to IRS forms, robust documentation is critical for substantiating your credit — especially if your return is ever reviewed or audited.

Be sure to maintain:

🧠 Descriptions of Qualified Projects – Highlighting technical challenges and your approach

📊 Breakdowns of QREs – Including wages, supply costs, and contract research

⏱️ Time Tracking Evidence – Logs or estimates of time spent on R&D

🧮 Methodology Notes – Explaining how you calculated and allocated QREs

These supporting materials are not submitted directly to the IRS but are essential for compliance and audit readiness.

✅ Final Thoughts

The R&D Tax Credit can be a game-changer for businesses investing in product development, software, or innovation — but only if filed correctly. By using the appropriate IRS forms — particularly Forms 6765, 3800, and 8974 — and maintaining clear documentation, you can maximize your credit while staying in full compliance with tax law.

💡 Need help navigating the R&D tax credit process? Partnering with a tax advisor or R&D credit specialist can simplify everything from eligibility checks to filing and documentation — so you can focus on growing your business through innovation.